Introduction to Biometric Authentication in Financial Services

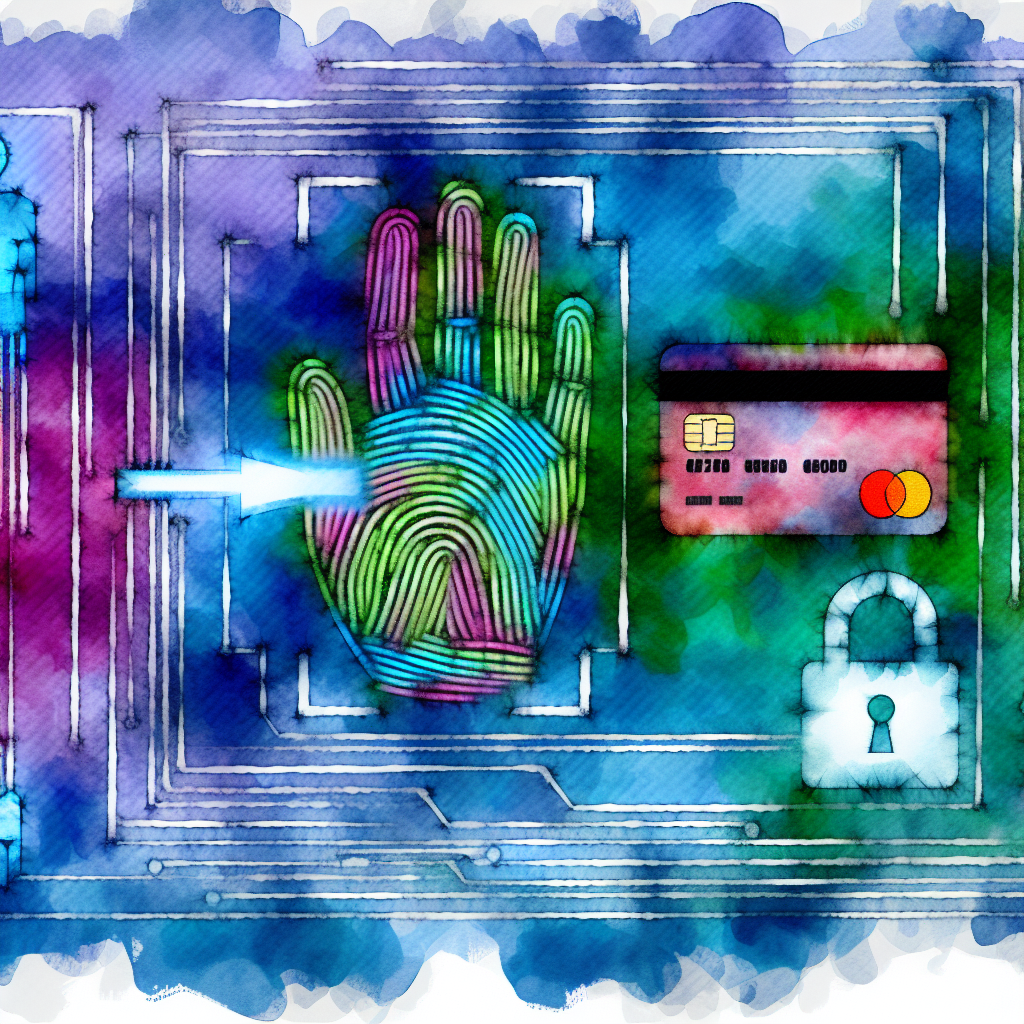

Biometric authentication is rapidly becoming a staple in the financial services sector as organizations pursue more robust security measures to protect sensitive data and financial transactions. At its core, biometric authentication involves using unique physiological characteristics—like fingerprints, facial recognition, or voice patterns—to verify an individual’s identity. These methods offer an additional layer of security that supplements traditional password-based systems, which are often vulnerable to breaches.

The adoption of biometric solutions in banking and credit card services is driven by the need for efficient, user-friendly, and secure authentication methods. As cyber threats continue to evolve, financial institutions must offer solutions that enhance security without compromising the user experience. Biometric technologies stand out as promising tools in this pursuit, offering the dual benefits of simplicity for consumers and advanced security protocols for businesses.

The intersection of biometric technology and financial services represents a significant shift toward a future where transactions can be as secure as they are seamless. This paradigm allows users to enjoy peace of mind knowing that their identities and finances are protected by sophisticated technologies that are difficult to replicate or steal. As the industry continues to evolve, so too will the development and refinement of biometric systems, which aim to offer an unrivaled level of security for financial transactions.

This article will delve into the various aspects of biometric authentication and its role in enhancing credit card transaction security. From understanding the rise of credit card fraud to exploring cutting-edge biometric technologies and their implementation, we’ll examine how these advances offer improved safety for consumers and financial institutions. We’ll also consider the challenges and limitations, highlight case studies, and explore future trends in this transformative sector.

The Rise of Credit Card Fraud and the Need for Enhanced Security

Credit card fraud is an escalating concern for both financial institutions and consumers, with billions of dollars lost annually to fraudulent activities. This rise in fraud can be attributed to several factors, including the increasing sophistication of cybercriminals, the expanded use of digital transactions, and the vulnerabilities inherent in traditional security measures like passwords and PINs.

As the digital payments landscape expands, so does the attack surface for potential fraudulent activities. Hackers and fraudsters have developed advanced methods to breach security systems, hence compromising user credentials and sensitive data stored by financial institutions. The high incidence rate of data breaches underscores the urgent need for enhanced security measures that can effectively protect consumer data and financial transactions.

Biometric authentication presents a compelling solution to this growing challenge. Unlike traditional authentication methods that rely on knowledge-based credentials, such as passwords or PINs, biometrics depend on unique physiological traits that are difficult to replicate. This significantly reduces the risk of identity theft and fraudulent transactions, making it a critical component in modern-day payment security strategies.

The implementation of biometric authentication technologies allows for a proactive approach to security, addressing vulnerabilities before they can be exploited. By integrating biometric solutions into their security protocols, financial institutions can provide a fortified defense against fraud, thereby protecting both their clients and their reputational integrity. This shift is not just about preventing losses; it’s about gaining consumer trust and ensuring a secure transaction ecosystem.

Overview of Biometric Authentication Technologies Used in Transactions

Biometric authentication technologies encompass a wide range of methods, each with its distinct advantages and applications in enhancing transaction security. These technologies leverage unique human characteristics, making them more reliable and secure than traditional authentication forms.

Fingerprint Recognition

Fingerprint recognition is one of the most widely used forms of biometric authentication. It works by scanning and mapping the unique patterns of a user’s fingerprint, enabling secure access through a simple touch. This method is highly efficient and user-friendly, providing a fast and reliable way to authenticate transactions without requiring users to remember complex passwords.

Facial Recognition

Facial recognition technology uses sophisticated algorithms to analyze and verify an individual’s facial features. By capturing an image of the face, it creates a digital map that can be matched against stored profiles in a database. This technology offers a hands-free, swift, and effective authentication process, which is particularly useful in environments that require seamless security measures without physical contact.

Voice Recognition

Voice recognition technology identifies and authenticates users based on the unique patterns in their voice. This method analyzes voice pitch, tone, and frequency to establish identity, offering an efficient means of verification that can be particularly advantageous in telephone banking or other verbal interactions. Voice recognition provides a convenient and unobtrusive way to ensure that only authorized users gain access to sensitive financial information.

In addition to these primary technologies, emerging forms such as iris scanning and behavioral biometrics are gaining traction, expanding the horizon of possibilities for secure and user-friendly authentication methods. The ongoing development and integration of such technologies promise to uphold the integrity and confidentiality of financial transactions in an increasingly digital world.

How Fingerprint, Facial, and Voice Recognition Improve Transaction Safety

The integration of fingerprint, facial, and voice recognition technologies into credit card transactions significantly enhances security by adding an extra layer of protection that is not easily bypassed.

Fingerprint Recognition

Fingerprint authentication is a highly effective security measure due to the uniqueness of each individual’s fingerprint pattern. Here’s how it elevates transaction safety:

- Precision: Fingerprint recognition technologies have a high accuracy rate, significantly reducing the risk of unauthorized access.

- Convenience: Users can complete transactions swiftly without the need for codes or passwords.

- Security: Difficult to spoof, providing a robust defense against identity theft and fraud.

Facial Recognition

Facial recognition enhances security by using biometric data that is both unique and challenging to counterfeit. Here’s why it stands out:

- Hands-Free Authentication: Allows for secure verification without physical contact, ideal for a frictionless user experience.

- Advanced Detection: Modern algorithms can detect attempts to use photos or videos for unauthorized access.

- Scalable: Easily integrates into various platforms, increasing its applicability across different transaction types.

Voice Recognition

Voice recognition adds another layer of security, particularly in remote banking situations. Its advantages include:

- Non-Intrusive: Offers an easy-to-use, seamless user experience.

- Speaker Recognition: Distinguishes between different speakers, even if they have similar voice tones.

- Adaptability: Can be implemented in scenarios where hands-on interaction is not feasible, like phone-based transactions.

Together, these technologies form a multi-layered authentication strategy that mitigates the risks associated with credit card fraud, ensuring that transactions are not only secure but also convenient and user-centric.

The Implementation Process of Biometrics in Credit Card Networks

The implementation of biometric authentication in credit card networks requires a structured and strategic approach, ensuring seamless integration with existing systems while maintaining high security standards.

Phase 1: Assessment and Planning

The first step involves a comprehensive assessment of the current security infrastructure and identification of specific vulnerabilities that biometric technologies could address. During this phase, financial institutions analyze customer data security requirements and determine how biometric authentication can fit into their broader security strategies.

Phase 2: Technology Selection and Testing

In this phase, institutions must select appropriate biometric technologies to integrate into their systems—be it fingerprint, facial recognition, voice recognition, or a combination thereof. Rigorous testing follows to ensure compatibility, effectiveness, and user acceptance. The selected systems must be tested in real-world scenarios to identify potential issues and make necessary adjustments.

Phase 3: Integration and Deployment

Upon successful testing, biometric technology is integrated into the card network. This involves updating software systems, training personnel, and educating customers about the new authentication processes. Financial institutions may initiate phased rollouts, starting with limited user groups to gradually expand based on feedback and performance assessments.

Phase 4: Continuous Monitoring and Maintenance

Post-deployment, continuous monitoring of the biometric systems is crucial to maintain security integrity. Regular updates and maintenance ensure the technologies evolve alongside emerging security threats and technological advances. Institutions also must remain vigilant in their oversight to quickly address any technical issues or security breaches that may arise.

The seamless implementation of biometric authentication in credit card networks allows for a strengthened security infrastructure that enhances consumer trust and reduces fraud incidents, paving the way for safer and more efficient transactions.

Benefits of Using Biometric Authentication for Consumers and Businesses

Biometric authentication offers tangible advantages for both consumers and businesses, making it an attractive security option in the evolving landscape of digital finance.

Benefits for Consumers

- Enhanced Security: Biometric data is less susceptible to being lost, stolen, or forgotten, providing a robust defense against fraud.

- Convenience: Eliminates the need to remember complex passwords or PINs, streamlining the transaction process.

- Improved User Experience: Offers swift and seamless transaction completion, enhancing customer satisfaction and loyalty.

Benefits for Businesses

- Fraud Reduction: Biometric systems deter fraudulent activities, reducing financial loss and enhancing the institution’s reputation.

- Operational Efficiency: Simplifies the authentication process, thereby decreasing administrative costs associated with password resets and account recovery.

- Competitive Advantage: Offering cutting-edge security measures attracts tech-savvy consumers and provides a differentiation point in a crowded market.

Biometric authentication not only fortifies security against growing threats but also promotes operational efficiency and elevates the customer experience, thereby benefiting all parties involved in financial transactions.

Challenges and Limitations of Biometrics in Financial Services

Despite its many advantages, implementing biometric authentication in financial services is not without challenges and limitations that must be carefully managed.

Privacy Concerns

Biometric data comprises sensitive personal information, raising significant privacy issues. Consumers may be hesitant to share their biometric details due to potential misuse or cyber threats. Financial institutions must ensure robust data protection policies and transparent communication to gain consumer trust.

Technology Limitations

Biometric systems require high-quality sensors and advanced algorithms to function accurately. Inadequate hardware or poor conditions, such as low lighting or ambient noise, can lead to false rejections or acceptances. These technological limitations demand continuous improvement and optimization of biometric solutions.

Implementation Costs

Adopting biometric systems can involve significant investment in hardware, software, and training, particularly for smaller institutions with limited budgets. The cost-benefit analysis must evaluate the long-term savings from reduced fraud and enhanced security against the immediate costs of biometric implementation and maintenance.

While biometric authentication presents promising solutions to many security issues, overcoming these challenges requires strategic planning, investment, and ongoing innovation.

Case Studies of Financial Institutions Using Biometric Authentication Successfully

Several financial institutions worldwide have successfully integrated biometric authentication, setting benchmarks for enhancing security and user experience in credit card transactions.

Bank A: Pioneering Fingerprint Authentication

Bank A was among the first to introduce fingerprint authentication for mobile banking applications. By incorporating fingerprint-based access, the bank significantly reduced instances of account breaches and simplified login processes for its customers. The bank saw a marked improvement in customer engagement and trust, which translated into higher adoption rates of digital banking services.

Credit Card Company B: Facial Recognition for Enhanced Security

Credit Card Company B implemented facial recognition technology to authenticate online transaction initiations. This step not only reduced fraudulent transactions but also streamlined the user experience by eliminating the need for additional passwords. The use of facial recognition was met with widespread consumer approval, enhancing brand reputation and driving loyalty.

Financial Group C: Innovating with Voice Recognition

Financial Group C adopted voice recognition for its phone banking services, offering a secure and convenient authentication method. Customers appreciated the ease and efficiency of using their voice for verification, which improved service accessibility and customer experience. The move also significantly lowered the frequency of fraud attempts, thereby safeguarding both consumer and company interests.

These case studies exemplify how strategic implementation of biometric technology can lead to successful outcomes, significantly mitigating fraud risks and enhancing consumer satisfaction.

Regulatory Considerations for Deploying Biometrics in Financial Transactions

The deployment of biometric authentication in financial transactions must navigate a complex landscape of regulatory requirements designed to protect consumer rights and data integrity.

Data Protection and Privacy Laws

Biometric data is subject to stringent data protection regulations, including the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Financial institutions must ensure compliance by implementing robust security measures and allowing individuals to control their biometric data, including access rights and data deletion options.

Communication and Consumer Consent

Informed consent is a pivotal requirement when deploying biometric systems. Consumers must be adequately informed about how their biometric data will be collected, used, stored, and protected. Obtaining explicit consent through clear communication is crucial for compliance and fostering trust with users.

Industry Standards and Guidelines

Organizations must adhere to industry standards and best practices for biometric technology, which prescribe guidelines on system implementation, data management, and security protocols. Certification and consistent audit practices are vital for ensuring continuous compliance and standardization across the industry.

Navigating these regulatory frameworks ensures that biometric authentication systems are not only effective but also ethically and legally sound, safeguarding consumers’ rights while enhancing transaction security.

Future Trends in Biometric Authentication for Credit Card Security

As technology advances, several trends are emerging in the field of biometric authentication, promising to reshape credit card security.

Multi-Modal Biometrics

The future is heading towards multi-modal biometric systems that use two or more biometric modalities (e.g., fingerprint and facial recognition) for enhanced accuracy and security. This approach minimizes the risk of authentication errors and provides a more comprehensive layer of security by verifying multiple unique identifiers simultaneously.

Integration with Blockchain Technology

Blockchain offers a decentralized approach to storing and verifying biometric data, enhancing security and transparency. This integration can prevent fraud by ensuring that once biometric data is captured and stored, it cannot be altered or tampered with, providing a secure verification mechanism.

Artificial Intelligence and Machine Learning

AI and machine learning are playing increasingly significant roles in biometric authentication, helping to improve system accuracy and adapt to new fraud patterns. These technologies can analyze data more quickly and accurately than traditional methods, enabling faster and more reliable identity verification processes.

As these trends unfold, the landscape of credit card security will continue to evolve, leveraging advanced biometric authentication to bridge the gap between convenience and security.

Tips for Consumers to Enhance Security with Biometric-Enabled Credit Cards

As biometric authentication becomes more prevalent, consumers can take several steps to ensure they are maximizing the security benefits of biometric-enabled credit cards.

Stay Informed

- Understand Biometric Options: Familiarize yourself with the types of biometric authentication available and how they work to make informed decisions about your security preferences.

- Keep Software Updated: Ensure that the apps and systems relying on biometric authentication are updated regularly to benefit from the latest security enhancements and features.

Protect Your Biometric Data

- Use Trusted Devices: Prefer authentic and verified devices for biometric authentication to avoid the risk of data leaks or breaches.

- Review Privacy Settings: Regularly check the privacy settings of your devices and financial apps to control and monitor access to your biometric data.

Report Suspicious Activity Promptly

- Be Vigilant: Stay aware of any unauthorized activity on your credit accounts and report suspicious activities immediately to your bank or credit card issuer.

- Utilize Alerts: Enable transaction alerts on your biometric-enabled credit cards to receive instant notifications of any activity on your account, providing an opportunity to respond quickly if fraud occurs.

Implementing these practices can help consumers unlock the full potential of biometric security features while maintaining control over their personal information and financial resources.

Frequently Asked Questions (FAQ)

What is biometric authentication?

Biometric authentication is a security process that uses an individual’s unique physiological traits, such as fingerprints, facial features, or voice patterns, to verify their identity and grant access to systems or transactions.

How do biometrics enhance credit card security?

Biometrics enhance credit card security by providing a more secure form of identity verification than traditional passwords or PINs, making it difficult for unauthorized users to gain access to accounts or complete fraudulent transactions.

Is my biometric data safe with financial institutions?

Financial institutions take significant measures to protect biometric data, adhering to strict data protection laws and using advanced security technologies. However, it’s essential for consumers to remain aware and select institutions with robust privacy policies.

What happens if my biometric data is compromised?

If biometric data is compromised, consumers should immediately contact their financial institution, which may take steps such as resetting authentication credentials or discontinuing the use of compromised data. Institutions typically have strict protocols to address such incidents.

Can I opt out of using biometric authentication for my transactions?

Most financial institutions allow consumers to opt-out of biometric authentication, offering alternative security measures such as passwords or two-factor authentication. Consumers concerned about privacy can discuss these options with their service providers.

Recap

- Biometric authentication offers a robust solution to combat the increasing threat of credit card fraud.

- Various biometric technologies such as fingerprint, facial, and voice recognition are pivotal in enhancing transaction security.

- The implementation process involves rigorous testing, integration, and continuous monitoring.

- While offering significant benefits, biometric authentication presents challenges such as privacy concerns and technological limitations.

- Case studies illustrate successful implementations in the financial sector.

- Regulatory compliance and awareness of future trends are crucial factors in the effective deployment of biometric systems.

- Consumers play a vital role in optimizing the security benefits offered by biometric-enabled credit cards.

Conclusion

The promise of biometric authentication in revolutionizing credit card security is undeniable. These sophisticated technologies provide a formidable arsenal against the persistent threat of fraud, offering both financial institutions and consumers a pathway to more secure transactions. As the technology advances, it not only enhances the user experience but also establishes new benchmarks for trust and reliability in financial exchanges.

The journey towards widespread adoption of biometric systems is replete with challenges—from privacy concerns to the cost of implementation—but the potential benefits far outweigh the hurdles. Financial institutions that champion these technologies will position themselves at the forefront of security innovation, setting the stage for a safer, more seamless global transaction environment.

As biometric technologies continue to evolve, their integration with other technological advancements such as AI and blockchain will likely propel the financial industry into a new era of security. Both consumers and businesses stand to gain from this transformation, paving the way for a future where authentication is as seamless as it is secure.

References

- International Biometric Society. “Biometric Authentication in Financial Services: Trends and Technologies.” Retrieved from: https://www.biometric.org/financial-services

- National Institute of Standards and Technology (NIST). “Security and Privacy Controls for Information Systems and Organizations.” Retrieved from: https://www.nist.gov/publications

- Financial Times. “The Future of Cybersecurity in Banking.” Retrieved from: https://www.ft.com/cybersecurity-banking

Deixe um comentário