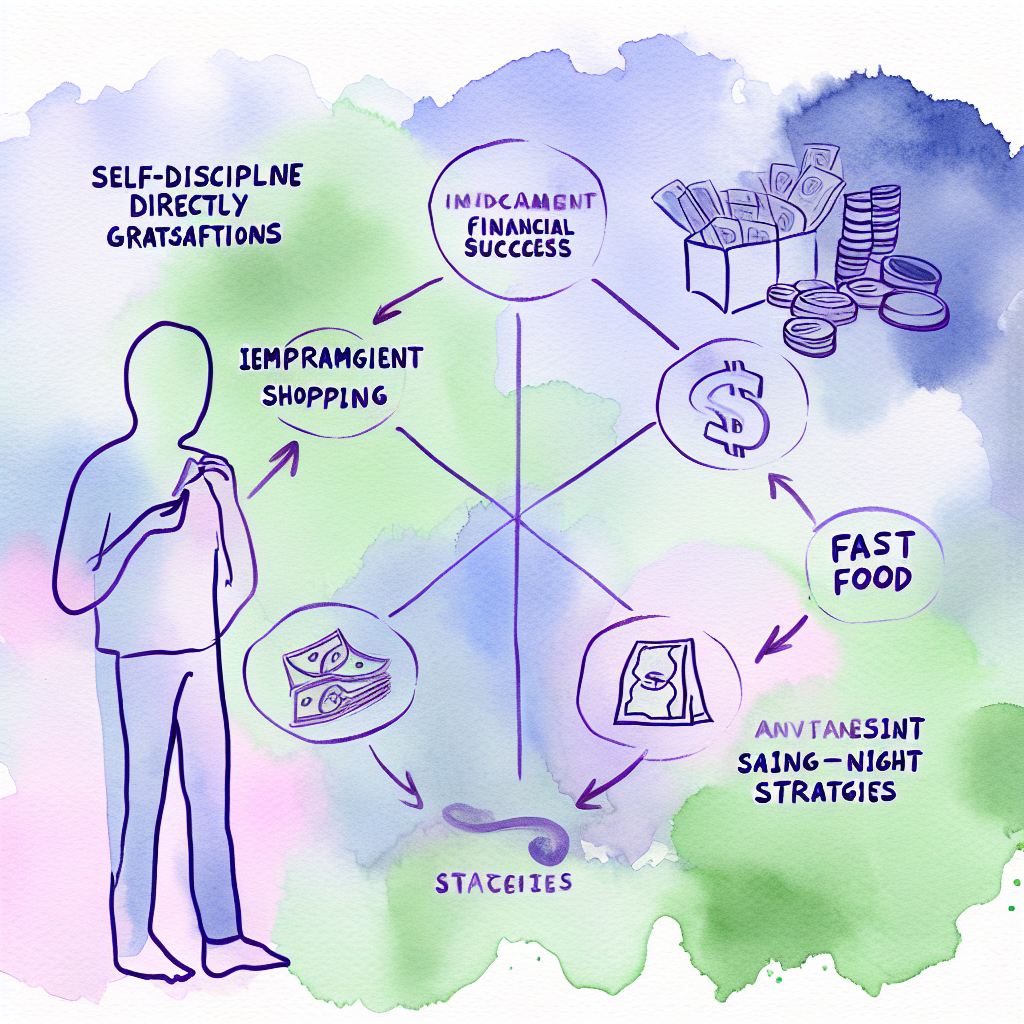

Understanding self-discipline and its influence on our lives is crucial, especially when it concerns our financial success. Finance can often seem like a subject governed purely by logic and spreadsheets, but beneath these figures lies a bedrock of personal behavioral patterns, such as discipline and habits. At its core, self-discipline is about making decisions that align with goals, often requiring the delay of short-term gratification for long-term achievements. This applies significantly to financial management, where how we handle money often directly correlates with our ability to remain disciplined.

Our daily financial choices, from budgeting and saving to investing, are monumental decisions that paint our future. Those who master self-discipline in their lives often find financial success becomes a more attainable goal. Understanding this, we must explore how to harness self-discipline to improve money management and ensure a successful financial future. The journey begins with a deep dive into what constitutes self-discipline and why it is so essential not just in theory, but in the practical application of achieving financial success.

Moreover, self-discipline can propel us into a state of financial freedom by providing a structural approach to earning, spending, and saving money. It’s easy to make a financial plan; sticking to it is where the real challenge—and the real reward—lies. Recognizing where and how self-discipline falters, and how to bolster it, is critical to avoiding the common pitfalls that can derail financial plans.

We also need to look at practical methods to nurture discipline in finance, such as building beneficial habits, leveraging budgeting as a tool for staying on track, and the importance of delayed gratification for future wealth accumulation. By examining real-life examples, we can see how effective financial discipline doesn’t merely emerge but is cultivated through consistent, deliberate actions over time.

Understanding Self-Discipline and Its Importance

Self-discipline can be compared to a muscle—it can be developed and strengthened over time with proper training and consistent effort. It involves the ability to control one’s emotions, behaviors, and desires in the face of external demands, in order to achieve a certain goal. This trait is synonymous with self-control and is a foundational skill that is integral to achieving long-term personal and financial goals.

One of the primary reasons why self-discipline is crucial is that it allows individuals to postpone immediate rewards for long-term gains. This capability is core to managing finances wisely, as it encourages savings and reducing frivolous expenditures. People with high self-discipline are often better at sticking to their budgets, saving for emergencies, and investing wisely for their future.

It’s also important to note that self-discipline plays a significant role in personal development beyond financial management. It encourages the cultivation of good habits, mitigates stress, and fosters resilience. By systematically improving self-discipline, individuals can thrive in other aspects of their lives, finding fulfillment and contentment beyond financial achievements.

The Connection Between Self-Discipline and Financial Success

The connection between self-discipline and financial success is profound and well-documented. Those who exhibit high levels of discipline tend to experience better outcomes in their financial portfolios because they are less susceptible to impulse purchases and are more likely to make sound financial decisions.

Self-discipline is relevant when it comes to controlling spending habits. Individuals with this trait are less likely to splurge on unnecessary items and often adhere to pre-set financial plans. They are adept at differentiating between needs and wants, which helps manage expenditures effectively and funnel savings into investment opportunities that grow wealth over time.

Furthermore, self-discipline is the backbone of consistent saving practices. It ensures individuals can allocate a portion of their earnings to savings accounts or investments without feeling deprived. This steadfast ability to prioritize future financial security over present desires sets the stage for substantial wealth accumulation. Success in financial arenas often boils down to this ability to maintain discipline over extended periods.

Building Habits to Enhance Financial Self-Discipline

Habits are powerful allies in the quest for enhanced self-discipline and, by extension, financial success. Building effective financial habits requires self-awareness and commitment to change. A vital first step is recognizing habits that hinder financial growth, such as unnecessary spending or neglecting savings, and taking deliberate actions to replace them with positive ones.

To begin with, one must set clear, achievable financial goals. Goals provide a direction and a motive, making it easier to establish routines that support these objectives. Small actions, like tracking daily expenses or regularly reviewing account statements, can gradually become habitual, leading to greater awareness and control over financial resources.

Another key habit to build is prioritizing needs over wants. By practicing mindful spending and focusing on what is truly necessary, individuals can better allocate their finances towards goals that enhance long-term stability. Consistently practicing this discernment fosters a disciplined mindset that naturally curbs excessive spending and encourages saving.

Practical Tips for Exercising Self-Discipline in Daily Financial Decisions

Exercising self-discipline in daily financial decisions can be simplified through practical strategies that promote smarter money management. Here are a few tips to help incorporate discipline into everyday decision-making:

-

Budget Before You Spend: Always prepare a budget before making any significant purchase. This ensures that spending aligns with your financial goals and prevents impulse buying.

-

Use Lists for Shopping: Whether it’s grocery shopping or buying clothes, always make a list. Sticking to this list helps curb impulsive purchases and keeps shopping under control.

-

Implement the 24-Hour Rule: For non-essential items, wait at least 24 hours before purchasing them. This waiting period often results in a clearer perspective on whether the purchase is necessary.

-

Automate Savings: Set up automatic transfers to savings accounts or retirement funds. This ensures saving doesn’t depend on motivation and becomes a regular financial activity.

-

Set Short-Term Limitations: Give yourself a monthly or weekly spending limit for non-essential items. These limits can help manage discretionary spending without feeling overly restrictive.

By incorporating these strategies, you can develop a financial routine that highlights restraint and careful planning, leading to stronger self-discipline and improved financial education.

The Role of Budgeting in Financial Discipline

Budgeting is a fundamental practice in financial discipline as it provides a structured layout of income versus expenditures. This roadmap is crucial for financial clarity and serves as a discipline-enhancing tool for maintaining control over financial resources.

A well-crafted budget outlines all sources of income and accounts for every necessary and discretionary expense. This transparency allows individuals to see exactly where their money is going, enabling them to make informed decisions that align with long-term goals. A good budget is detailed, yet flexible enough to accommodate changes without compromising financial stability.

Budgeting also promotes accountability. Regularly monitoring and adjusting a budget reinforces the discipline of sticking to financial plans, thus preventing overspending and encouraging saving. Moreover, adhering to a budget fosters a mindset of prioritizing necessities over luxuries, preparing individuals to handle financial challenges with greater confidence and finesse.

How Delayed Gratification Promotes Long-Term Wealth

Delayed gratification, the act of resisting the impulse to take an immediate reward in hopes of obtaining a more-valued reward in the future, is a pivotal concept in building wealth. Mastering this skill leads to significant financial benefits over time.

The psychology behind delayed gratification emphasizes the importance of patience and foresight. Those who can practice it are typically better at saving money, as they understand the future benefits outweigh immediate pleasures. This restraint is particularly evident in investing, where waiting for assets to appreciate yields greater returns compared to making rushed or emotionally driven decisions.

The impacts of delayed gratification can be profound. For instance, consistently investing in a retirement fund rather than spending that money immediately can reap profound benefits, due to compound interest. Essentially, delayed gratification is not merely about saying ‘no’ to a present desire but saying ‘yes’ to a future of potential financial stability and prosperity.

The Impact of Consistent Saving Habits

Consistent saving habits are a cornerstone of financial success, largely due to their compounded effects over time. By making a habit of saving, individuals build a financial cushion that not only secures their future but also opens doors to investment opportunities.

Savings act as a financial safety net for unforeseen expenses, reducing stress and the need for high-interest debt. It also provides the capital required for investment, which can further financial growth through interest accumulation and capital gains. Regular savings can be the difference between mere survival and thriving financially.

To cultivate consistent saving habits, it is essential to treat savings as a non-negotiable expense. Automating contributions to savings accounts ensures consistency without requiring daily conscious effort. This practice, combined with a disciplined approach to spending, allows saving to become a cornerstone rather than an afterthought of personal finance.

Investing Based on Disciplined Decision-Making

Disciplined decision-making is vital for successful investing. It involves making judgments based on data and a long-term perspective rather than emotions or trends. This approach reduces the risk associated with market volatility and impulsive actions.

The process begins with setting clear investment goals. Whether aiming for retirement savings or property investments, understanding objectives clarifies what kind of investments align with one’s financial blueprint. With disciplined investing, emotional biases like fear and greed are minimized, making it easier to weather market fluctuations.

Disciplined investors rely on research, diversification, and risk management strategies. They understand the importance of assessing risk tolerance and the need for a diversified portfolio to mitigate losses. This methodical approach reduces exposure to financial risks and aligns investments with long-term wealth generation.

| Aspect | Undisciplined Approach | Disciplined Approach |

|---|---|---|

| Decision Making | Emotion-driven, impulsive | Data-driven, strategic |

| Investment Strategy | Reactive, trend-based | Proactive, diversified |

| Goal Setting | Ambiguous, short-term-only | Clear, long-term-focused |

| Risk Management | Overexposure to risk, lack of planning | Balanced risk, planned and structured |

Overcoming Common Pitfalls in Financial Self-Discipline

Financial self-discipline is often challenged by common pitfalls that derail budgeting plans and saving goals. Overcoming these challenges involves recognizing and counteracting them with effective strategies.

A frequent pitfall is lifestyle inflation—when increased earnings lead to increased spending rather than saving. Combatting this involves consciously maintaining the same lifestyle even as earnings grow, allowing surplus income to boost savings or investments instead.

Another common issue is impulse buying. To counteract this, individuals can utilize techniques such as setting spending limits, avoiding unnecessary shopping triggers, and reflecting on purchases before committing. Developing financial mindfulness through regular spending reviews can also reveal patterns that need correction.

Lastly, a lack of financial knowledge or understanding can undermine self-discipline. Investing time in financial education, attending workshops, and seeking professional advice when necessary can enhance decision-making capabilities and reinforce disciplined financial behaviors.

Tracking Progress to Stay Motivated on Your Financial Journey

Tracking financial progress is vital to maintaining motivation and ensuring that goals remain visible and achievable. Keeping an eye on financial milestones helps maintain a disciplined approach by providing clear evidence of progress toward financial objectives.

Creating a simple system for tracking progress, such as spreadsheets or budgeting apps, allows regular review of income, expenses, savings, and investments. This consistency keeps individuals on track and provides insights into areas needing adjustment to meet annual or long-term targets.

Setting periodic financial reviews—monthly or quarterly—can reinforce discipline, ensuring spending remains aligned with budgets and savings goals. Recognizing and celebrating financial achievements, no matter how small, also contributes to sustained motivation, reinforcing positive financial habits and discipline.

Real-Life Examples of Financial Success Through Self-Discipline

Real-life examples of individuals who have achieved financial success through self-discipline abound, providing inspiration and tangible evidence of the rewards of staying the course.

Consider the story of Warren Buffett, an epitome of self-discipline in investing. Known for his frugality and strategic financial planning, Buffett remained steadfast with his investment strategy, focusing on value and maintaining patience through market ups and downs. His wealth accumulation is a testament to disciplined investing and mindful spending.

Another compelling example is personal finance author Dave Ramsey, who advocates for the principle of disciplined debt reduction and saving. Through his journey from bankruptcy to financial stability, Ramsey highlights the impact of budgeting and disciplined financial planning as cornerstones for financial success.

These examples illuminate the pathway toward financial security, making it clear how discipline compounds over time, paving the way for success and providing a model for aspiring individuals to follow.

FAQ

1. How can self-discipline improve my financial situation?

Self-discipline aids in budget adherence, controls unnecessary spending, and enhances saving strategies. It provides the structure necessary for aligning daily financial decisions with long-term goals, ultimately improving financial health.

2. What are some ways to develop better financial habits?

Better financial habits can be developed by setting clear goals, tracking expenses, using budgeting tools, automating savings, and regularly revisiting financial plans to ensure they align with current objectives.

3. How important is budgeting in achieving financial discipline?

Budgeting is fundamental for financial discipline. It provides a clear overview of income and expenses, ensuring money is allocated appropriately to meet financial goals without overspending.

4. Why is delayed gratification crucial for wealth accumulation?

Delayed gratification emphasizes the importance of patience and long-term thinking in financial decisions. It helps prioritize future financial stability over immediate pleasures, leading to substantial wealth growth over time.

5. Are there real-life examples of people using self-discipline to achieve financial success?

Yes, notable individuals like Warren Buffett and Dave Ramsey illustrate the power of disciplined financial practices. Their stories demonstrate how consistent discipline can lead to remarkable financial success.

Recap

In summary, self-discipline plays a critical role in achieving financial success, guiding important financial decisions such as budgeting, saving, investing, and delaying gratification. It fosters habits that align with long-term financial goals and prevents common pitfalls like lifestyle inflation and impulse spending. Real-life examples further illustrate the potential for achievement through disciplined financial behaviors, making self-discipline a proven strategy for wealth creation.

Conclusion

Self-discipline is an essential component of financial success, helping steer clear of common financial pitfalls and establishing structured routines that align with future goals. By understanding and inculcating discipline in financial affairs, long-term wealth becomes not just a possibility, but an inevitable outcome.

Implementing self-discipline involves embracing compassionate self-regulation, where one takes control of financial impulses, sets clear goals, and consistently monitors progress. The benefits extend beyond the confines of finance, contributing to overall personal development and greater life satisfaction.

Ultimately, self-discipline is not merely a means to financial freedom but a lifestyle choice that fosters stability and growth. By dedicating time and effort to nurture this trait, individuals can unlock significant opportunities, leading to enduring financial prosperity and personal well-being.

References

- Baumeister, R. F., & Tierney, J. (2011). Willpower: Rediscovering the Greatest Human Strength. New York: The Penguin Press.

- Duckworth, A. (2016). Grit: The Power of Passion and Perseverance. New York: Scribner.

- Thaler, R. H., & Sunstein, C. R. (2008). Nudge: Improving Decisions About Health, Wealth, and Happiness. New Haven: Yale University Press.

Deixe um comentário