Autor: joao pedro

-

How Immediate Gratification Can Hinder Your Investment Strategy

Introduction In an age where instantaneous gratification is just a click away, patience often seems outdated. This trend is profoundly affecting various aspects of life, including how we manage our finances and investments. The idea of waiting for something better has lost appeal when you can have something satisfactory right now. As we delve into…

-

How a Mindset of Abundance Can Transform Your Financial Life

How a Mindset of Abundance Can Transform Your Financial Life In today’s fast-paced world, financial concerns are prevalent across different age groups and demographics. Whether grappling with debt, striving for financial independence, or aiming for wealth accumulation, individuals find themselves constantly seeking ways to improve their financial life. A prevailing piece of advice centers around…

-

How Separating Personal from Business Finances Can Benefit Your Small Business

Introduction to the Importance of Financial Separation The path to running a successful small business is fraught with challenges, one of which is the critical task of financial management. Many entrepreneurs underestimate the importance of separating personal and business finances, a mistake that can lead to significant consequences. Proper financial separation is not just a…

-

How Cashback Platforms Can Aid in Expense Management

Introduction to Cashback Platforms In today’s fast-paced digital age, managing personal finances can often become a daunting task. With numerous expenses to account for and diverse financial products available, maintaining control over spending becomes critical. Among the various tools available for aiding in expense management, cashback platforms have emerged as a popular choice. They offer…

-

How Defining Financial Priorities Enhances Your Quality of Life

Introduction to Financial Priorities In an age where the chaos of life frequently drowns out the voice of financial reason, prioritizing finances can seem like an overwhelming task. From utility bills to luxury vacations, the nuances of spending and saving can evoke confusion and anxiety. Yet, amidst this apparent complexity lie the seeds of a…

-

Why Escaping Status-Driven Consumption Can Be Liberating

Introduction to Status-Driven Consumption In today’s fast-paced world, driven by social media influencers and the shiny allure of luxury brands, status-driven consumption has taken center stage in the lives of many individuals. This type of consumption centers on acquiring goods and experiences not purely for their utility or personal satisfaction but rather for the message…

-

The Importance of Visualizing Your Financial Goals to Achieve Them

Introduction to Financial Goal Visualization Setting financial goals is a fundamental component of achieving financial success, yet the journey towards these objectives can often seem daunting. Whether it’s saving for a down payment on a house, building a retirement fund, or planning for a child’s education, these goals require planning, discipline, and persistence. An effective…

-

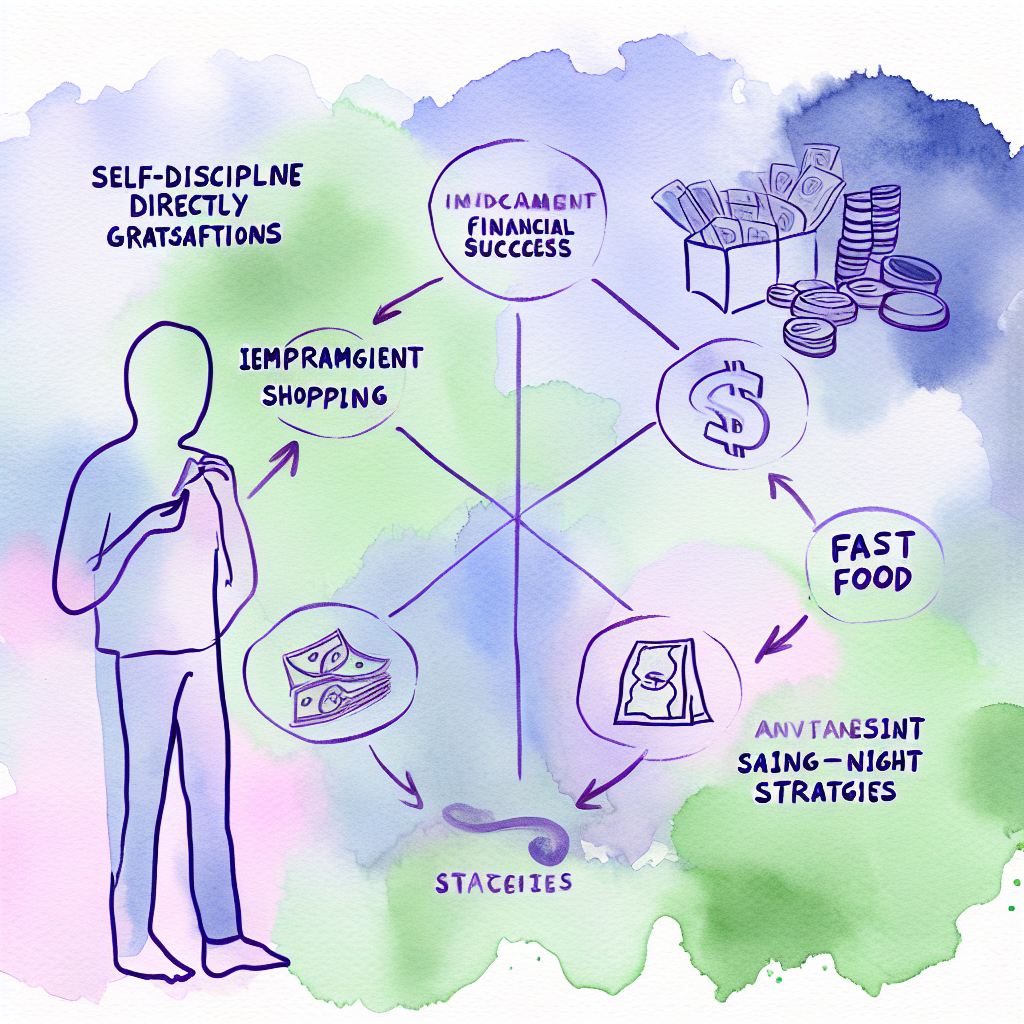

How Self-Discipline Directly Influences Your Financial Success

Understanding self-discipline and its influence on our lives is crucial, especially when it concerns our financial success. Finance can often seem like a subject governed purely by logic and spreadsheets, but beneath these figures lies a bedrock of personal behavioral patterns, such as discipline and habits. At its core, self-discipline is about making decisions that…

-

Why Financial Education Remains Overlooked and How to Address It

Introduction to Financial Education: Understanding Its Role in Society In today’s rapidly evolving financial landscape, understanding the basics of financial management has become increasingly crucial. Financial education empowers individuals by equipping them with the knowledge to manage their personal finances effectively, make informed financial decisions, and achieve financial stability. Despite its importance, financial education remains…

-

How Social Circles Influence Your Financial Decisions and Spending Habits

How Social Circles Influence Your Financial Decisions and Spending Habits In the complex web of daily living, social circles play an influential role in shaping various aspects of our lives, including financial decisions and spending habits. From childhood through adulthood, the people we surround ourselves with can significantly affect our perspectives on money. The influence…