Categoria: Tips

-

Understanding Zero-Fee Banking: An In-Depth Look at Financial Apps Offering No-Interest Loans

Understanding Zero-Fee Banking: An In-Depth Look at Financial Apps Offering No-Interest Loans In today’s rapidly evolving financial landscape, the concept of zero-fee banking has emerged as a revolutionary wave, challenging traditional banking paradigms. Zero-fee banking refers to financial services that offer everyday banking functions without the pesky fees that have long burdened consumers. At the…

-

Exploring AI-Powered Credit Cards: Enhancements Through Machine Learning

Exploring AI-Powered Credit Cards: Enhancements Through Machine Learning In recent years, the financial landscape has undergone a revolutionary shift with the advent of AI-powered credit cards. These innovative financial tools leverage cutting-edge technologies to provide a seamless, efficient, and secure user experience. As we delve into the dynamic intersection of artificial intelligence and financial products,…

-

How Virtual Reality is Revolutionizing Financial Education for the Future

Introduction to Virtual Reality in Education The evolution of technology has influenced nearly every field and industry, reshaping the ways people interact, learn, and work. One of the most anticipated technologies that experts believe will transform education is Virtual Reality (VR). Virtual Reality offers an immersive educational experience, providing environments where learners can engage in…

-

How to Avoid Being Swayed by Promotions and Marketing Tactics

Understanding how marketing and promotions influence consumer behavior is crucial in today’s world. As savvy consumers, we must equip ourselves with knowledge to navigate the myriad temptations placed before us by clever marketers. Every day, advertisements try to lure us into believing we need the latest product, often blurring the line between want and necessity.…

-

The Dangers of Poorly Planned Debt and How to Avoid Them

Introduction to Debt Planning In today’s fast-paced world, debt has become an integral part of life for many. From mortgages to student loans, and credit card balances, the reliance on borrowed money can often seem overwhelming. Despite this, borrowing is not inherently bad. Used wisely, debt can be a powerful tool for achieving financial goals…

-

Why Escaping Status-Driven Consumption Can Be Liberating

Introduction to Status-Driven Consumption In today’s fast-paced world, driven by social media influencers and the shiny allure of luxury brands, status-driven consumption has taken center stage in the lives of many individuals. This type of consumption centers on acquiring goods and experiences not purely for their utility or personal satisfaction but rather for the message…

-

The Importance of Regularly Reviewing Your Credit Score

Introduction to Credit Scores: What They Are and Why They Matter In today’s financial landscape, the credit score has become a crucial component of our personal finance toolkit. While once considered a tool mainly for banks and lenders, credit scores now play a pivotal role in our day-to-day lives. From determining loan eligibility to influencing…

-

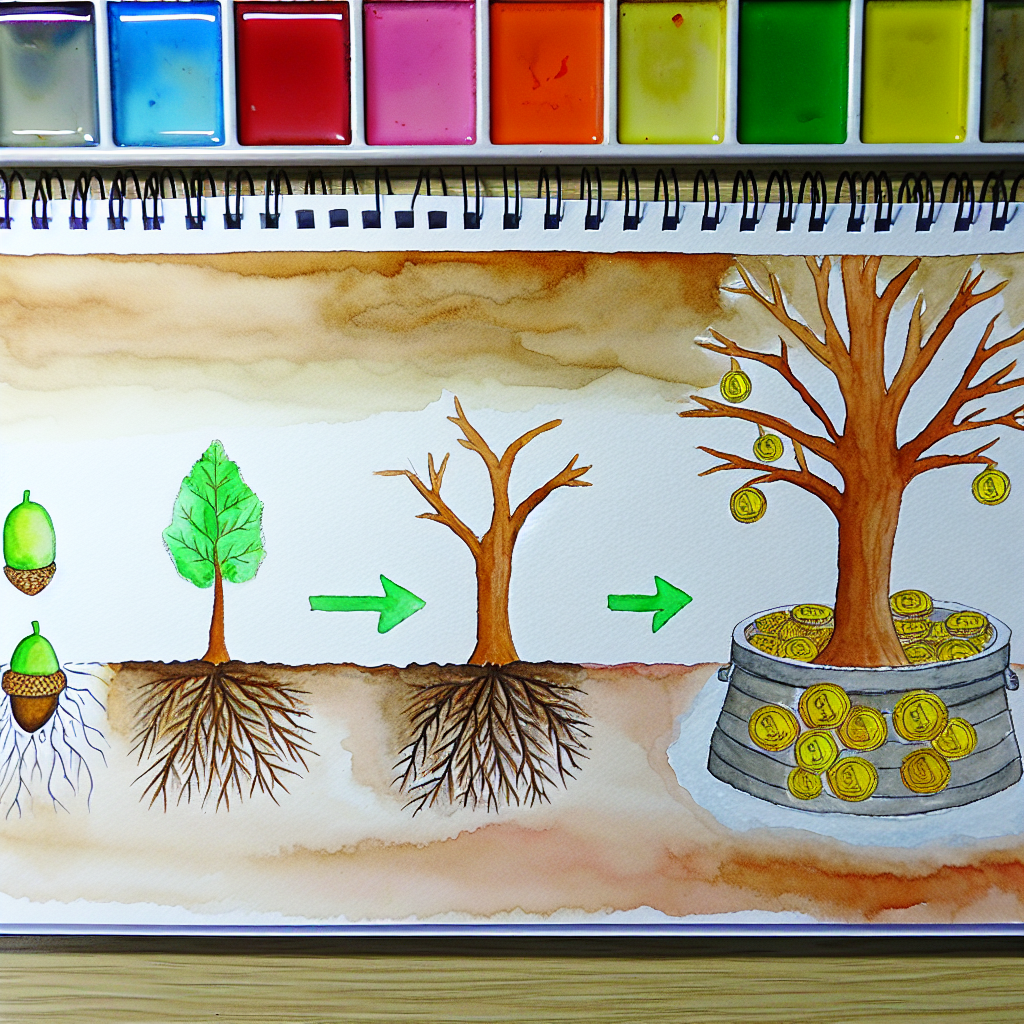

Why Patience is Essential for Building Wealth Successfully

Introduction to Wealth Building Building wealth is a goal that resonates with many individuals, but the path to achieving it often involves complex decisions and foresight. Unlike the riches that sometimes promise quick resolutions, true wealth-building is a disciplined journey requiring strategic planning. It extends beyond accumulating a certain amount of money and involves generating…

-

Why You Shouldn’t Fully Trust ‘Hot Tips’ in Investment Decisions

Introduction: The Allure of ‘Hot Tips’ in Investments In the realm of investing, there is an undeniable allure to the idea of ‘hot tips.’ These nuggets of seemingly inside information or speculative predictions are often presented as quick and straightforward paths to achieving significant financial gains. For many, the dream of discovering the next big…

-

How Technology is Transforming the Lending Market Revolution

Introduction to Technological Advancements in Lending In the past decade, the lending market has experienced a seismic shift, largely driven by the wave of technological advancements transforming its landscape. Traditionally rooted in manual operations and face-to-face transactions, the lending industry has taken impressive strides toward digitization. As technology continues to evolve, its impact on lending…