Autor: forneas

-

Understanding Zero-Fee Banking: An In-Depth Look at Financial Apps Offering No-Interest Loans

Understanding Zero-Fee Banking: An In-Depth Look at Financial Apps Offering No-Interest Loans In today’s rapidly evolving financial landscape, the concept of zero-fee banking has emerged as a revolutionary wave, challenging traditional banking paradigms. Zero-fee banking refers to financial services that offer everyday banking functions without the pesky fees that have long burdened consumers. At the…

-

Exploring AI-Powered Credit Cards: Enhancements Through Machine Learning

Exploring AI-Powered Credit Cards: Enhancements Through Machine Learning In recent years, the financial landscape has undergone a revolutionary shift with the advent of AI-powered credit cards. These innovative financial tools leverage cutting-edge technologies to provide a seamless, efficient, and secure user experience. As we delve into the dynamic intersection of artificial intelligence and financial products,…

-

How Virtual Reality is Revolutionizing Financial Education for the Future

Introduction to Virtual Reality in Education The evolution of technology has influenced nearly every field and industry, reshaping the ways people interact, learn, and work. One of the most anticipated technologies that experts believe will transform education is Virtual Reality (VR). Virtual Reality offers an immersive educational experience, providing environments where learners can engage in…

-

How Financial Frustration Can Be Overcome with Strategic Planning

In today’s fast-paced and ever-changing world, financial frustration is a common challenge that many individuals face. This frustration often stems from a lack of control over one’s finances, leading to stress and anxiety. The key to overcoming financial stress lies in adopting strategic planning measures that provide a clearer path to financial stability and growth.…

-

How Financial Education Can Prevent Family Crises and Foster Stability

Introduction to Financial Education In today’s rapidly evolving economic landscape, financial education stands out as a cornerstone for personal and family security. With the complexities of financial markets, consumer products, and the sheer volume of information available, understanding personal finance is more critical than ever. Financial education empowers individuals and families to make informed decisions,…

-

The Importance of Regularly Reviewing Your Credit Score

Introduction to Credit Scores: What They Are and Why They Matter In today’s financial landscape, the credit score has become a crucial component of our personal finance toolkit. While once considered a tool mainly for banks and lenders, credit scores now play a pivotal role in our day-to-day lives. From determining loan eligibility to influencing…

-

Why Patience is Essential for Building Wealth Successfully

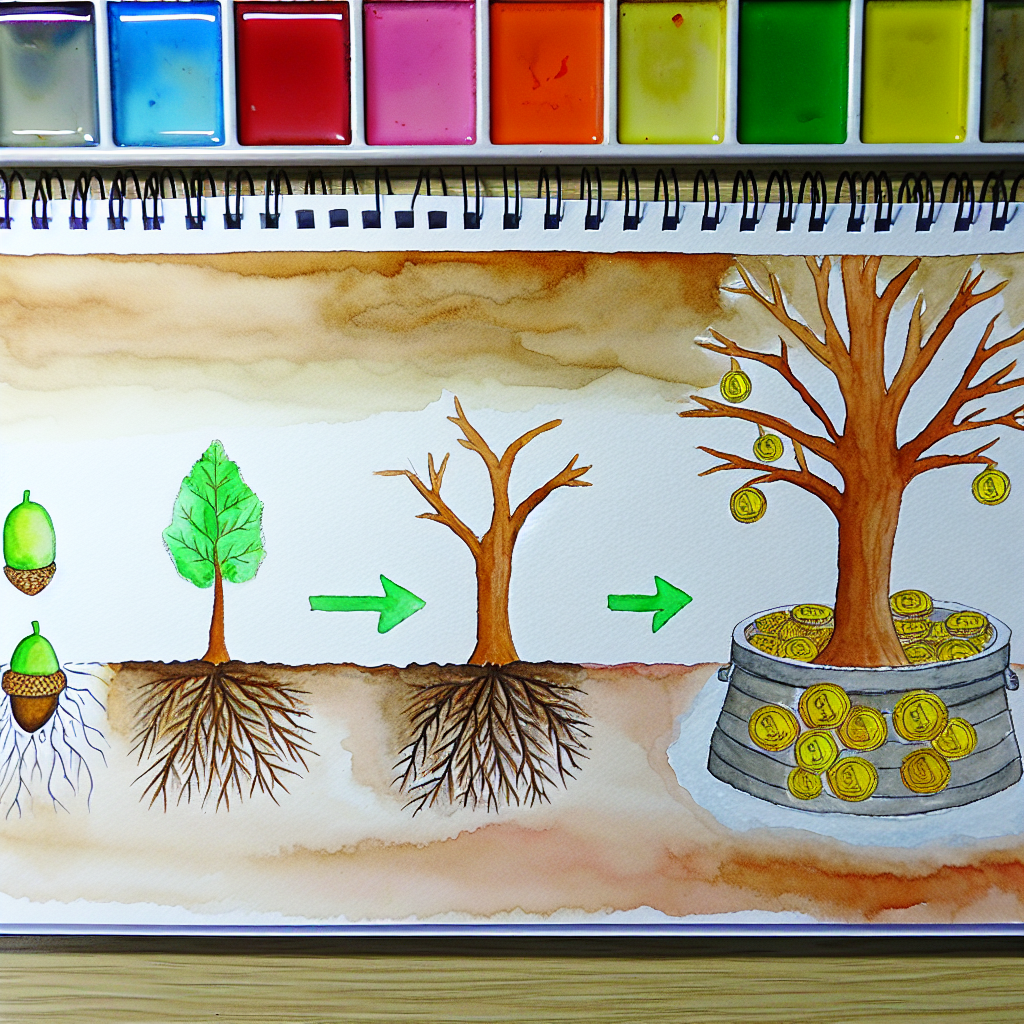

Introduction to Wealth Building Building wealth is a goal that resonates with many individuals, but the path to achieving it often involves complex decisions and foresight. Unlike the riches that sometimes promise quick resolutions, true wealth-building is a disciplined journey requiring strategic planning. It extends beyond accumulating a certain amount of money and involves generating…

-

Why You Shouldn’t Fully Trust ‘Hot Tips’ in Investment Decisions

Introduction: The Allure of ‘Hot Tips’ in Investments In the realm of investing, there is an undeniable allure to the idea of ‘hot tips.’ These nuggets of seemingly inside information or speculative predictions are often presented as quick and straightforward paths to achieving significant financial gains. For many, the dream of discovering the next big…

-

How Technology is Transforming the Lending Market Revolution

Introduction to Technological Advancements in Lending In the past decade, the lending market has experienced a seismic shift, largely driven by the wave of technological advancements transforming its landscape. Traditionally rooted in manual operations and face-to-face transactions, the lending industry has taken impressive strides toward digitization. As technology continues to evolve, its impact on lending…

-

The Role of Trust When Negotiating Loans and Financing

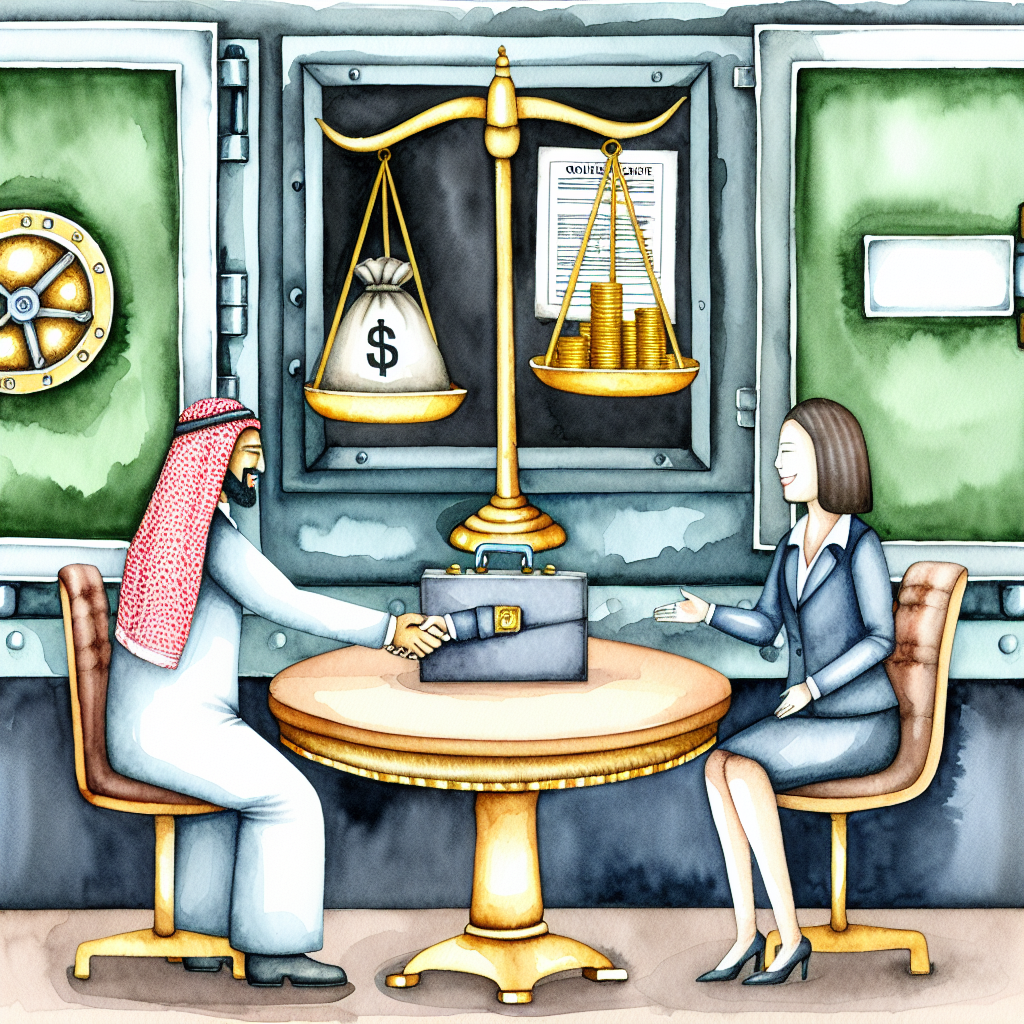

Introduction to Trust in Financial Transactions In the realm of finance, trust stands as a pivotal pillar upon which the entire system is built. Whether it’s opening a bank account, investing in stocks, or negotiating loans, trust underscores every financial interaction. This virtue of trust becomes even more relevant in our ever-globalizing economy, where transactions…