Categoria: Financial education

-

Virtual Reality Banking: How Tech Will Transform Financial Management

Introduction to Virtual Reality in Banking The finance landscape is no stranger to technological innovation, but the introduction of virtual reality (VR) marks a new frontier in the digital evolution of banking. This sophisticated technology, once the realm of video gaming and design, is poised to alter the way we perceive financial management. As industries…

-

How to Build Financial Independence Using Crypto-Backed Loans: A Comprehensive Guide

Introduction to Financial Independence and Cryptocurrency Financial independence is a goal that resonates with many, a concept that implies having enough savings or investments to afford a desired lifestyle without being reliant on a traditional paycheck. The concept isn’t about amassing wealth for the sake of it but achieving a level of freedom that allows…

-

How AI-Generated Financial Education Can Empower Underbanked Populations

Introduction Underbanked populations represent a significant portion of the global society, often existing in a financial limbo where access to mainstream banking services is limited or altogether absent. According to the World Bank, over 1.7 billion adults globally remain unbanked, with a large percentage lacking sufficient financial education. This lack of access is frequently attributed…

-

How Financial Education Can Prevent Family Crises and Foster Stability

Introduction to Financial Education In today’s rapidly evolving economic landscape, financial education stands out as a cornerstone for personal and family security. With the complexities of financial markets, consumer products, and the sheer volume of information available, understanding personal finance is more critical than ever. Financial education empowers individuals and families to make informed decisions,…

-

Why Building a Strong Credit History is Essential for Financial Success

Introduction to Credit History: Understanding the Basics In today’s fast-paced financial world, understanding the intricacies of credit history has become essential for anyone seeking to navigate the economic landscape efficiently. At its core, credit history is a record of an individual’s borrowing and repayment activities over time. This history includes various components such as credit…

-

How a Good Financial Plan Can Help Reduce Anxiety and Improve Well-Being

How a Good Financial Plan Can Help Reduce Anxiety and Improve Well-Being In today’s fast-paced world, financial security has become synonymous with peace of mind. However, financial anxiety is a global phenomenon that is reportedly on the rise. The stress associated with managing personal finances can detract significantly from one’s mental and physical health. Many…

-

The Importance of Visualizing Your Financial Goals to Achieve Them

Introduction to Financial Goal Visualization Setting financial goals is a fundamental component of achieving financial success, yet the journey towards these objectives can often seem daunting. Whether it’s saving for a down payment on a house, building a retirement fund, or planning for a child’s education, these goals require planning, discipline, and persistence. An effective…

-

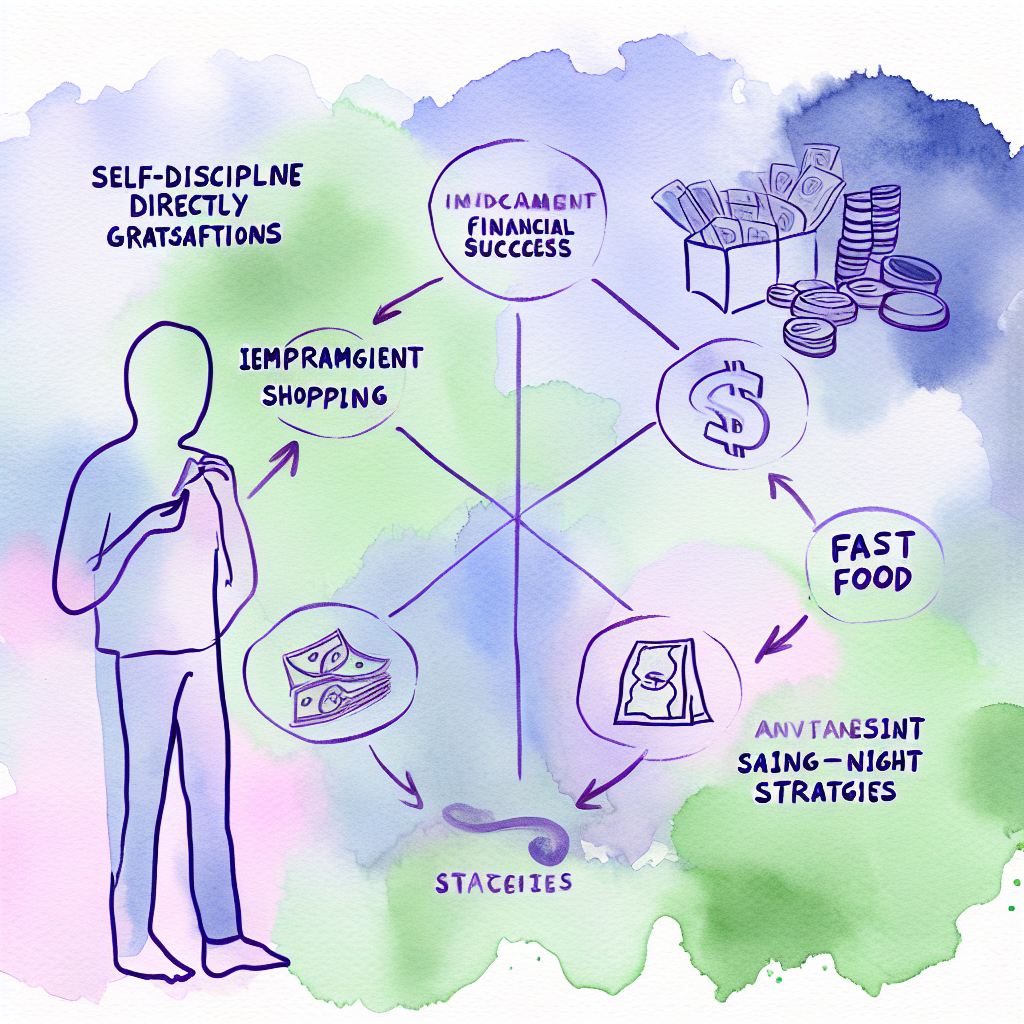

How Self-Discipline Directly Influences Your Financial Success

Understanding self-discipline and its influence on our lives is crucial, especially when it concerns our financial success. Finance can often seem like a subject governed purely by logic and spreadsheets, but beneath these figures lies a bedrock of personal behavioral patterns, such as discipline and habits. At its core, self-discipline is about making decisions that…

-

Why Financial Education Remains Overlooked and How to Address It

Introduction to Financial Education: Understanding Its Role in Society In today’s rapidly evolving financial landscape, understanding the basics of financial management has become increasingly crucial. Financial education empowers individuals by equipping them with the knowledge to manage their personal finances effectively, make informed financial decisions, and achieve financial stability. Despite its importance, financial education remains…

-

How Social Circles Influence Your Financial Decisions and Spending Habits

How Social Circles Influence Your Financial Decisions and Spending Habits In the complex web of daily living, social circles play an influential role in shaping various aspects of our lives, including financial decisions and spending habits. From childhood through adulthood, the people we surround ourselves with can significantly affect our perspectives on money. The influence…