Autor: forneas

-

How to Make Credit Decisions Without Impulsivity

Introduction to Credit Decision-Making In today’s fast-paced financial landscape, making credit decisions has become an integral part of managing one’s personal finances. The process is not merely about acquiring a credit card or loan; it’s about understanding the obligations and opportunities that come with it. Whether you’re purchasing a car, buying a home, or simply…

-

How Impulsive Behavior Impacts Credit Card Usage and Financial Health

Understanding and managing impulsive behavior is crucial for maintaining good financial health, especially in the era of credit cards and easy access to consumer goods. Impulsive behavior can significantly affect one’s financial decision-making process and often leads to unexpected debt. This article delves into how impulsive behavior impacts credit card usage and, consequently, financial health.…

-

How Compound Interest Can Accelerate Wealth Accumulation

How Compound Interest Can Accelerate Wealth Accumulation When people first encounter the concept of compound interest, it can seem both intriguing and overwhelming. On one hand, compound interest offers a powerful way to grow wealth significantly over time; on the other, the mathematics behind it can be complex for those uninitiated in financial jargon. Yet,…

-

How the Culture of Immediacy Impacts Your Financial Health

How the Culture of Immediacy Impacts Your Financial Health The culture of immediacy is a defining trait of the 21st century, impacting various facets of life, including our financial health. This phenomenon is driven primarily by the pervasive influence of technology, which has expedited access to information and services, often only a click away. From…

-

Why Financial Control Apps Are Essential for Achieving Success

Introduction In today’s fast-paced world, managing personal finances has become more crucial than ever. With the complexities of modern living, people are finding it increasingly challenging to keep track of their expenses, savings, debts, and investments. This is where financial control apps come into play, offering tools and resources that simplify personal finance management for…

-

The Importance of Setting Clear Financial Goals for Financial Stability

The journey to achieving financial stability often begins with setting clear financial goals. This fundamental step in personal finance is crucial for those who wish to take charge of their financial future. Setting financial goals offers a roadmap to guide individuals through various financial decisions, providing a sense of direction and purpose. Without such goals,…

-

How Investment Diversification Minimizes Risks and Enhances Returns

Introduction to Investment Diversification Investment diversification is a fundamental principle that prudent investors have relied on for decades to enhance returns while minimizing risks. This strategy involves spreading investments across various financial instruments, industries, and other categories to reduce exposure to any one particular asset or risk. By not putting all of one’s eggs in…

-

Why Avoiding Unnecessary Loans is Key to Financial Stability

Introduction to Financial Stability: Understanding its Importance Financial stability is akin to the foundation of a house, underpinning everything else built upon it. Without a solid financial base, individuals may find their economic well-being precarious, much like an edifice swaying in the wind. In today’s complex financial landscape, achieving and maintaining financial stability is more…

-

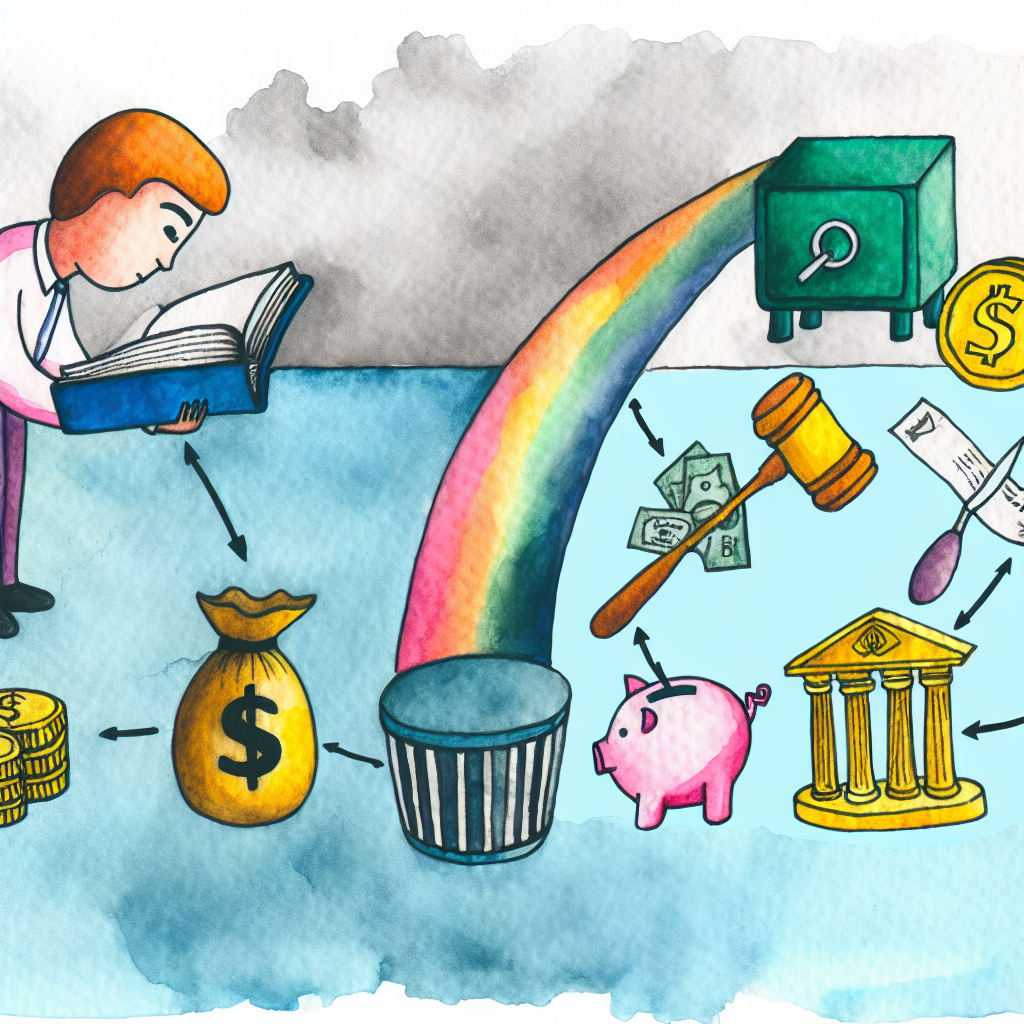

The Importance of Understanding Financial Products Before Using Them

Understanding financial products is essential for making informed choices about managing personal and professional finances. In today’s complex financial landscape, a vast array of products are available that cater to various needs and objectives. These range from basic savings accounts to more intricate financial instruments like derivatives and mutual funds. While these products can help…

-

How Conscious Consumption Impacts Personal Finances Positively

Introduction to Conscious Consumption In today’s fast-paced world, where consumerism often overshadows mindfulness, the concept of conscious consumption emerges as a beacon of hope. Conscious consumption refers to the mindful choices individuals make about their purchases, ranging from everyday items to more significant investments. This awareness-focused lifestyle advocates for purchasing practices that align with one’s…