In the ever-evolving world of digital finance, two innovations have emerged as critical players in revolutionizing how we think about and interact with monetary systems: Ethereum and Smart Contracts. These technologies have not only challenged traditional financial mechanisms but also opened up new avenues for secure, transparent, and efficient financial transactions.

Ethereum, as a leading blockchain platform, plays a fundamental role in this transformation. It extends beyond being merely a cryptocurrency; Ethereum is a platform for developing and hosting a vast array of decentralized applications (DApps), with Smart Contracts at its core. The introduction of Smart Contracts on Ethereum’s blockchain has created a paradigm shift in executing and automating contractual agreements without the need for intermediaries.

Smart Contracts, essentially self-executing contracts where the terms are directly written into code, represent a breakthrough in how agreements are forged and upheld. They offer a level of automation, transparency, and security that is unmatched by traditional contract law. As such, their application within the financial sector is both a natural and revolutionary step.

This development has prompted a reevaluation of existing financial frameworks and the exploration of new possibilities for innovation in digital finance. From redefining lending and borrowing to streamlining payments and settlements, Ethereum and Smart Contracts are reshaping the financial landscape. In this article, we delve into Ethereum and Smart Contracts, exploring their workings, benefits, and real-world applications within the financial sector, while also examining the challenges they face and their future potential to transform global finance.

Introduction to Ethereum and its role in digital finance

Ethereum stands as a groundbreaking innovation in the realm of blockchain technology, fundamentally altering how digital finance is conceptualized and implemented. Unlike its predecessor Bitcoin, which is primarily a digital currency, Ethereum introduces a comprehensive platform that enables developers to build and deploy decentralized applications (DApps) and Smart Contracts. This unique capability facilitates a more extensive and dynamic use of blockchain technology in various sectors, especially in finance.

The pivotal role of Ethereum in digital finance stems from its ability to provide a decentralized, secure, and transparent environment for conducting financial transactions and agreements. With Ethereum, financial services are not only made more accessible but are also liberated from the constraints and risks associated with traditional centralized systems, such as fraud, censorship, and third-party interference.

Moreover, Ethereum’s native cryptocurrency, Ether (ETH), serves as a crucial component in executing Smart Contracts and operating within the Ethereum ecosystem. It functions not only as a digital currency but also as a “fuel” for running DApps, ensuring the smooth and autonomous execution of Smart Contracts. This synergy between Ethereum and Smart Contracts is revolutionizing digital finance, offering a more efficient, transparent, and inclusive financial system.

What are Smart Contracts? Understanding the basics

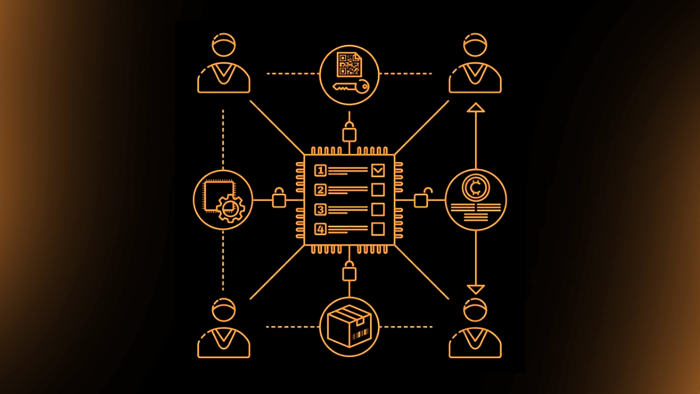

Smart Contracts represent a significant leap forward in executing and managing contractual agreements. At its core, a Smart Contract is a self-executing contract with the agreement between buyer and seller directly written into lines of code. The code and the agreements contained within it exist across a distributed, decentralized blockchain network. This technology enables Smart Contracts to run automatically when predetermined conditions are met, without the need for intermediaries.

The basics of Smart Contracts can be summarized in three primary characteristics:

- Autonomy: Smart Contracts eliminate the need for intermediary parties, enabling direct transactions between parties and reducing the possibility of manipulation or error.

- Trust and Transparency: All transactions and their outcomes are recorded on a blockchain, accessible by all parties, ensuring unparalleled transparency and trust.

- Security: Blockchain technology provides robust security measures, making Smart Contracts virtually tamper-proof and secure.

These characteristics make Smart Contracts particularly appealing in various financial applications, from simple transactions to complex, multi-part financial agreements.

How Smart Contracts work on the Ethereum platform

The operational mechanism of Smart Contracts on the Ethereum platform is fascinating and multi-faceted. At its most basic, a Smart Contract is deployed to the Ethereum blockchain in the form of a specific code, written in a programming language called Solidity. This code stipulates the rules and conditions under which the contract operates, as well as the outcomes based on those conditions.

Here’s a simplified overview of how Smart Contracts work on Ethereum:

- A developer writes the Smart Contract code, defining the rules and conditions.

- The contract is deployed to the Ethereum blockchain, where it is distributed across the network.

- When the predefined conditions are met, the Smart Contract executes automatically, without the need for manual intervention or intermediaries.

- The result of the contract’s execution is then recorded on the Ethereum blockchain, ensuring transparency and immutability.

This process underscores the autonomous and efficient nature of Smart Contracts, facilitating a wide range of financial transactions on the Ethereum platform.

Benefits of using Ethereum and Smart Contracts in finance

Ethereum and Smart Contracts collectively offer multiple benefits that are transforming the finance sector. Below are some of the key advantages:

- Enhanced security: The decentralized nature of blockchain, combined with cryptographic security measures, minimizes risks commonly associated with financial transactions.

- Reduced costs and increased efficiency: By eliminating intermediaries, transactions become faster and less costly.

- Increased transparency and trust: The immutable record of transactions on the blockchain enhances transparency, building trust among parties.

- Accessibility and inclusivity: Ethereum’s decentralized platform enables broader access to financial services, especially for unbanked populations.

These benefits demonstrate the potential of Ethereum and Smart Contracts to create a more efficient, secure, and inclusive financial system.

Real-world applications of Smart Contracts within the financial sector

Smart Contracts are being leveraged in several ways within the financial sector, showcasing their versatility and impact. Some demonstrated applications include:

- Decentralized Finance (DeFi): DeFi platforms use Smart Contracts to offer traditional financial services, such as borrowing, lending, and insurance, in a decentralized manner, without the need for banks or other financial institutions.

- Tokenization of assets: Smart Contracts enable the representation of real-world assets, like real estate or commodities, as digital tokens on the blockchain, simplifying transactions and increasing liquidity.

- Automated compliance and reporting: By coding regulatory requirements into Smart Contracts, compliance can be automated, reducing the burden on financial institutions and ensuring more consistent adherence to regulations.

These applications highlight the transformative potential of Smart Contracts in reshaping financial services and operations.

Challenges and limitations of implementing Smart Contracts

Despite their potential, implementing Smart Contracts also faces several challenges and limitations:

- Technical barriers: The complexity of writing and deploying Smart Contracts requires significant technical expertise, limiting accessibility.

- Scalability: As the number of Smart Contracts on a blockchain increases, so do the demands on the network’s capacity, potentially leading to slower transaction times and higher costs.

- Legal and regulatory issues: The legal status of Smart Contracts is still under debate in many jurisdictions, complicating their use in legally binding agreements.

Addressing these challenges is crucial for the broader adoption and optimization of Smart Contracts in the financial sector.

Comparing Ethereum Smart Contracts with traditional financial agreements

Traditional financial agreements often involve multiple intermediaries, complex paperwork, and lengthy processes, which can introduce delay, error, and increased costs. In contrast, Ethereum Smart Contracts offer a more streamlined and efficient approach. Here is a comparison:

| Feature | Traditional Financial Agreements | Ethereum Smart Contracts |

|---|---|---|

| Speed | Slow due to manual processing | Instantaneous upon conditions being met |

| Cost | High due to intermediaries and administrative fees | Lower, due to automated execution and lack of intermediaries |

| Security | Susceptible to fraud and errors | Highly secure due to cryptographic techniques and decentralization |

| Transparency | Limited, depending on the institution | High, as records are immutable and publicly verifiable on the blockchain |

This comparison underscores the benefits and transformative potential of Ethereum Smart Contracts in the financial sector.

Future outlook: The impact of Ethereum and Smart Contracts on global finance

The future impact of Ethereum and Smart Contracts on global finance looks promising, with potential for widespread transformation. The continued development of the Ethereum platform, including upgrades for scalability and efficiency, will further enhance the utility of Smart Contracts. Moreover, as regulatory frameworks evolve to better accommodate blockchain technologies, the adoption and application of Smart Contracts in finance are expected to accelerate.

This trajectory suggests a future where Smart Contracts and Ethereum play central roles in a more inclusive, transparent, and efficient global financial system.

Case studies: Successful financial projects using Ethereum

Several successful financial projects demonstrate the utility and effectiveness of Ethereum and Smart Contracts:

- MakerDAO: This DeFi platform uses Smart Contracts to offer decentralized loans, providing users with stablecoin loans against their cryptocurrency collateral.

- Compound: Compound utilizes Smart Contracts to create a decentralized lending and borrowing platform, allowing users to earn interest on deposits and borrow against them.

- Uniswap: As a decentralized exchange, Uniswap leverages Smart Contracts for automated token exchanges, facilitating liquidity and trading without the need for traditional exchange mechanisms.

These case studies exemplify the innovative applications and potential of Ethereum and Smart Contracts within the financial sector.

Conclusion: Why Ethereum and Smart Contracts are transformative for finance

Ethereum and Smart Contracts are undeniably transformative technologies within the financial sector. By providing a decentralized, secure, and efficient platform for financial transactions and agreements, they challenge traditional financial mechanisms and pave the way for a more inclusive and transparent financial system. The benefits, such as reduced costs, increased efficiency, and enhanced security, coupled with the growing array of real-world applications, underscore the significant potential of these technologies.

While challenges and limitations remain, particularly concerning scalability, technical complexity, and regulatory uncertainty, the continued development and adoption of Ethereum and Smart Contracts hold the promise of overcoming these hurdles. The future of finance, characterized by decentralization, innovation, and accessibility, is closely tied to the evolution and implementation of these groundbreaking technologies.

The transformative power of Ethereum and Smart Contracts extends beyond mere technological innovation; it represents a shift in how financial transactions and agreements are conceptualized and executed. By harnessing the potential of these technologies, the financial sector can move towards a more equitable, efficient, and transparent future.

Recap

- Ethereum is a decentralized platform that enables the creation and execution of Smart Contracts.

- Smart Contracts automate and enforce the terms of an agreement based on predetermined conditions.

- Benefits of using Ethereum and Smart Contracts in finance include enhanced security, reduced costs, increased efficiency, and improved transparency.

- Real-world applications within the financial sector, such as DeFi, asset tokenization, and automated compliance, showcase the versatility and impact of Smart Contracts.

- Despite challenges related to technical complexity, scalability, and regulatory issues, the future of Ethereum and Smart Contracts in finance looks promising.

- Case studies like MakerDAO, Compound, and Uniswap illustrate successful implementations of Ethereum and Smart Contracts in the financial sector.

FAQ

- What is Ethereum?

- Ethereum is a blockchain platform that enables the development and execution of decentralized applications (DApps) and Smart Contracts.

- How do Smart Contracts work?

- Smart Contracts automatically execute transactions and enforce terms when predefined conditions are met, without the need for intermediaries.

- What are the benefits of using Smart Contracts in finance?

- Benefits include enhanced security, reduced transaction costs, increased efficiency, and greater transparency.

- Can Smart Contracts replace traditional contracts?

- While they offer many advantages, Smart Contracts currently complement rather than replace traditional contracts, mainly due to existing legal and regulatory frameworks.

- How secure are Smart Contracts?

- Smart Contracts are highly secure due to the use of cryptographic techniques and blockchain technology, which makes them tamper-proof and reliable.

- What challenges do Smart Contracts face?

- Challenges include technical complexity, scalability issues, and the need for clearer regulatory guidance.

- Are there successful financial projects using Ethereum?

- Yes, projects like MakerDAO, Compound, and Uniswap have successfully leveraged Ethereum and Smart Contracts to innovate within the financial sector.

- What is the future outlook for Ethereum and Smart Contracts in finance?

- The outlook is bright, with ongoing developments poised to address current challenges and expand the applications and impact of Smart Contracts in global finance.

References

- Buterin, V. (2013). Ethereum Whitepaper. https://ethereum.org/en/whitepaper/

- Mougayar, W. (2016). The Business Blockchain: Promise, Practice, and Application of the Next Internet Technology. Wiley.

- Antonopoulos, A. M., & Wood, G. (2018). Mastering Ethereum: Building Smart Contracts and DApps. O’Reilly Media.

Deixe um comentário