Introduction to Wealth Building

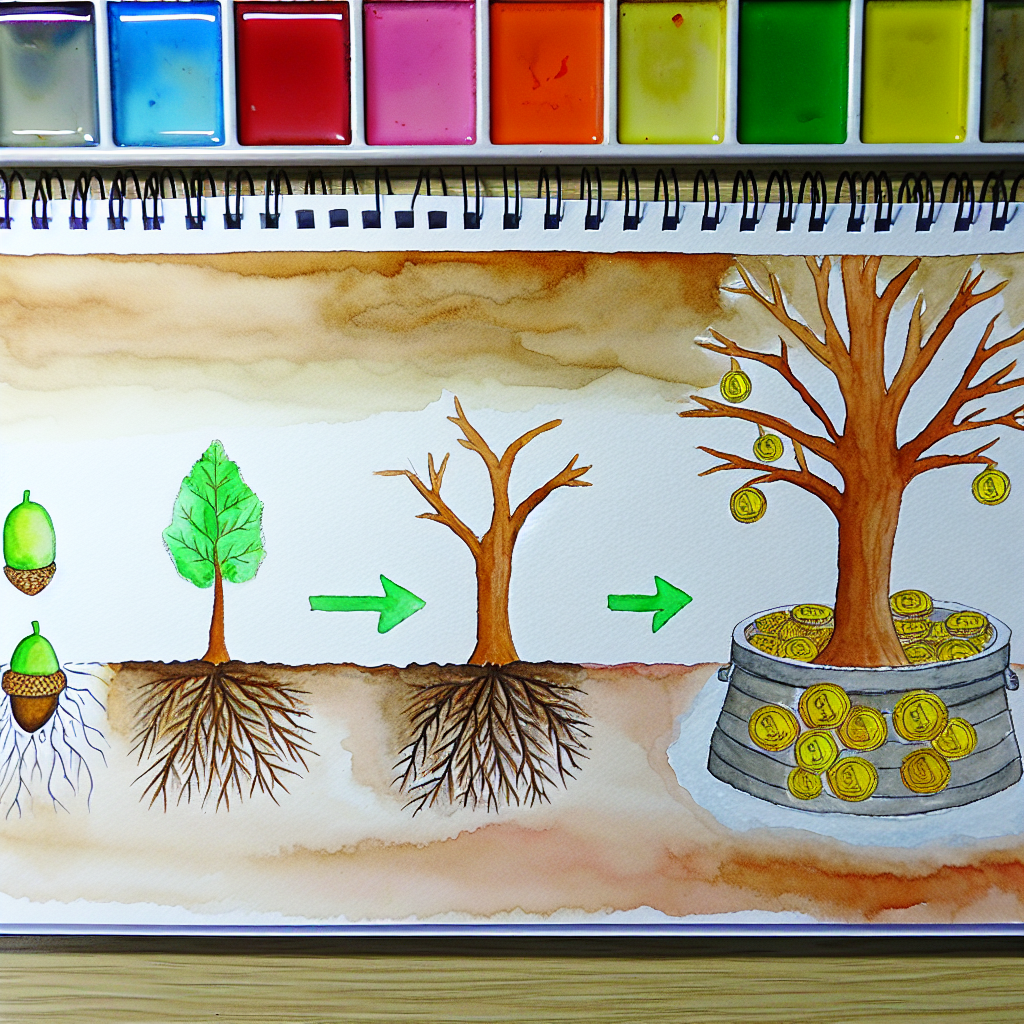

Building wealth is a goal that resonates with many individuals, but the path to achieving it often involves complex decisions and foresight. Unlike the riches that sometimes promise quick resolutions, true wealth-building is a disciplined journey requiring strategic planning. It extends beyond accumulating a certain amount of money and involves generating a sustainable system of growth that can support one’s future aspirations and security. To navigate this journey successfully, patience emerges as a quintessential component, often determining the difference between fleeting prosperity and enduring financial health.

Many people enter the financial world hoping to make a quick profit without considering the broader implications of their actions. The allure of get-rich-quick schemes can be exciting, yet they often lead to disappointment when deeper roots of financial understanding are ignored. Wealth building mandates an approach that acknowledges the time required to generate consistent returns and mitigate risks effectively. Emphasizing patience as a core principle can offer individuals a more meaningful and stable approach to growing their wealth.

Moreover, patience intersects significantly with the time value of money—a fundamental economic concept. The time value of money suggests that a dollar today is worth more than a dollar in the future due to its potential earning capacity. By appreciating this principle, one can better gauge how waiting, investing, and allowing money to multiply over time can lead to lucrative outcomes. This perspective sheds light on why patience is not merely a virtue in wealth building but a necessity.

Ultimately, wealth-building involves steering clear from transient gains and setting sight on the larger picture. Although patience may seem passive, it functions as an active principle that requires ongoing cultivation and consistency in financial behaviors and decisions. By integrating patience deeply into financial strategies, individuals can position themselves better to withstand market volatility, make informed decisions, and achieve sustainable financial health.

The Role of Patience in Financial Success

To grasp why patience is critical in financial success, it’s pivotal to understand its impact at both psychological and practical levels. Financial patience involves resisting the temptation for immediate gratification in favor of long-term rewards. This mindset encourages individuals to eschew impulsive buying decisions or high-risk investments, choosing instead to prioritize stable and diversified portfolios.

Patience offers a protective measure against the turbulence of market fluctuations. When investors panic during downturns, they often sell assets quickly, locking in losses and missing potential recoveries. A patient investor maintains composure, trusting the long-term upward trajectory of well-researched investments. This stability is a cornerstone of financial patience, ensuring that short-term setbacks don’t derail long-term goals.

The cultivation of patience in financial dealings also embodies a strategic advantage. It encourages individuals to frameworks that enhance their wealth accumulation in an organized manner. By meticulously setting clear, achievable financial milestones and adhering to them, one is more likely to realize their wealth-building goals comprehensively. This vision-backed patience fosters a disciplined journey towards financial success, emphasizing consistency rather than volatility.

Understanding the Time Value of Money

The concept of the time value of money underscores why patience stands as a crucial pillar in wealth building. At its core, the time value of money postulates that the financial value of money changes over time, primarily due to its potential earning capacity. This principle forms a critical foundation for making informed investment decisions, emphasizing the importance of starting investments early to maximize returns.

For instance, consider two individuals: one starts investing at age 25 and the other at age 35, assuming the same annual contribution and rate of return. The person who begins a decade earlier invariably accumulates a substantially larger nest egg than the one who started later—a testament to the compounding power of money over time. This example highlights the exponential benefits that come with embracing patience in the context of financial growth.

| Age Started | Years of Investment | Total Investment | Future Value |

|---|---|---|---|

| 25 | 40 | $200,000 | $545,000 |

| 35 | 30 | $150,000 | $300,000 |

The table above illustrates the hypothetical growth of investments over time, reinforcing how starting early and exercising patience can yield significant financial advantages. Understanding the concept of the time value of money necessitates an appreciation for the future potential of today’s investments—a perspective that encourages long-term planning and patience.

Common Misconceptions About Quick Wealth

In the pursuit of financial independence, many aspirants are seduced by the promise of quick wealth. It’s crucial, however, to discern reality from fantasy in these promises. One common misconception is that substantial wealth can be generated in the absence of due diligence and strategic planning. Frequently, these quick routes do not account for risks or the underlying financial literacy required to sustain wealth gained.

Another prevailing myth is that getting involved in high-risk investments can rapidly yield significant returns. While risk-taking has its place in a balanced financial portfolio, relying solely on high-risk maneuvers often results in large-scale losses rather than wealth accumulation. The appeal of quick profits glamorizes the idea of risk but fails to emphasize the necessity of calculated risk balancing.

Moreover, the notion that financial markets are predictable enough to guarantee immediate returns is a profound misconception. Markets are inherently volatile and subject to myriad influences. Assuming that anyone can reliably predict and capitalize on short-term market movements is misleading and can be a direct pathway to financial failure. Adopting patience, therefore, helps to resist the allure of these myths and aligns one’s strategy with proven, sustainable practices.

How Patience Leads to Informed Financial Decisions

Patience in financial management profoundly influences decision-making processes, steering them towards informed and rational choices. When individuals embrace patience, they provide themselves the luxury of time to evaluate their financial options comprehensively before committing resources. This deliberation is essential in assessing potential returns against associated risks.

One aspect of informed decision-making involves conducting thorough research and engaging with knowledgeable advisors, leveraging expertise over impulsive decisions. Patience allows individuals to establish solid knowledge bases before making monetary commitments, fostering decisions that are resilient to unforeseen pitfalls. Careful analysis and calculated skepticism are virtues induced by patience in the context of financial strategies.

Additionally, patience empowers individuals to resist manipulative market voices that often hype certain stocks or investment vehicles. These can include short-term trendy products or speculative ventures that, while appealing, may not align with one’s long-term financial objectives. A commitment to patience prioritizes steady growth over the fleeting success of market trends, encouraging a consistent investment strategy based on factual analysis and personal financial goals.

The Benefits of Long-Term Investment Strategies

Building wealth sustainably demands long-term investment strategies that embrace the power of patience. Opting for a long-term horizon provides several benefits that are often absent in short-sighted approaches. A key advantage is the ability to benefit from compound interest, which can exponentially grow investments over time without requiring constant input or oversight.

Long-term strategies also allow investors the opportunity to ride out market volatility. Inevitably, the financial markets will experience ups and downs. By investing with a long horizon, individuals can endure these swings without the fear of immediate financial jeopardy. This resilience, afforded by patience, enables a steadier accumulation of wealth and a greater likelihood of meeting financial goals.

Moreover, long-term investing promotes dollar-cost averaging, a technique that minimizes the impact of market volatility by spreading investment purchases over time. This strategy benefits from patience, as it reduces the emotional stress associated with timing the market and produces an average purchase price over time that tends to smoothen short-term market variances.

Case Studies: Successful Wealth Accumulation Through Patience

Examining real-world examples can illuminate how patience plays a transformative role in wealth accumulation. Consider the case of Warren Buffett, whose investment philosophy is deeply rooted in patience. His long-standing company, Berkshire Hathaway, exemplifies the efficacy of enduring investments in fundamentally strong businesses over fluctuating market trends.

Another noteworthy account is that of Grace Groner, a secretary who bought $180 worth of stock in Abbott Laboratories in 1935. By exercising unwavering patience and allowing her investments to mature over decades, Groner transformed her modest stake into a $7 million fortune. Such cases demonstrate how ordinary individuals can achieve extraordinary financial results through disciplined patience.

Similarly, the institution of index funds by Jack Bogle showcases a wealth-building strategy that capitalized on patience. These funds underscore the importance of investing in broader market indices and holding them for the long-term, thereby yielding returns that outperform many actively managed funds. The consistent annual growth of index funds exemplifies their capacity for wealth sustainability through patient investing.

Overcoming Impatience in Financial Planning

While the advantages of patience are well-documented, overcoming impatience—a common human trait—requires conscious efforts. Recognizing triggers for impulsive financial decisions is a first step. Emotional responses to market volatility or sudden lifestyle desires can often lead one astray. Acknowledging these triggers helps create an awareness that can prevent premature decisions.

Developing a comprehensive financial plan that outlines clear short-term and long-term goals can also counteract impatience. When objectives are clearly defined, and progress tracked consistently, it becomes easier to remain aligned with the larger goal, reducing the allure of distractions. This roadmap serves as a physical reminder of the commitment to patient wealth-building principles.

Finally, collaborating with financial advisors or mentors offers an external perspective to reinforce patience. Engaging with someone seasoned in financial planning can provide reassurances during uncertain times. Their experience and insights offer valuable guidance, aiding individuals in adhering to patience as a cornerstone in their wealth-building endeavors.

Steps to Cultivate Patience for Financial Growth

Cultivating patience for financial growth is an intentional and proactive process, vital for achieving long-term fiscal health. Here are steps to foster financial patience:

-

Educate yourself continuously: Knowledge is empowerment. Regularly updating your financial literacy enables better comprehension of market dynamics, improving your confidence in patiently formulated strategies.

-

Set realistic goals: Establish clear, achievable objectives that allow for small wins over time. Celebrating minor accomplishments reinforces patience by demonstrating tangible progression.

-

Practice mindfulness: Developing the habit of mindful decision-making reduces impulsivity. Practicing mindfulness in finances involves taking deliberate steps and pausing to consider long-term impacts of choices.

-

Regular reviews of financial plans: Reviewing financial plans periodically reaffirms commitment to your long-term strategy, helping identify areas of adjustment while reinforcing patience in executing the plan.

-

Develop a support network: Having a circle of trusted advisors or mentors provides a sounding board for ideas and decisions, fortifying patience through collective wisdom and shared experiences.

Balancing Patience with Actionable Financial Steps

While patience is crucial, it must coexist with action to achieve financial success. Balancing patience with proactive steps involves setting a clear plan and routinely adjusting strategies to reflect life changes and market conditions. This dynamic balance ensures that while one remains committed to long-term goals, they are not passive in the execution.

Staying informed about market trends and financial advancements is crucial in making responsive adjustments that don’t compromise the overall patient investment strategy. Continuous learning and engagement with financial education resources maintain an active stance, empowering individuals to make calculated revisions as needed.

Executing actionable steps also entails setting regular checkpoints for financial progress assessment. These assessments provide indicators of success or highlight areas needing adjustment, ensuring that patient strategies are both dynamic and goal-oriented. This balance harmonizes the virtues of patience with the practicality of strategy implementation.

Conclusion: Patience as a Pillar of Sustainable Wealth

Patience is an essential pillar for sustainable wealth building, intertwining with every aspect of financial success. It not only guides long-term investment strategies but also immunizes individuals against the temptations of quick profit schemes. As a mindset and strategy, patience ensures that decisions are grounded in rational analysis rather than impulsive actions.

A focused commitment to patience fosters resilience in the face of market volatility and aligns actions with well-researched, long-term financial goals. For wealth to be sustainable, it must be grounded in practices that prioritize stability and gradual growth over immediate gains, emphasizing the importance of patience in finance.

Ultimately, patience is transformative in wealth accumulation. By extending the time horizon and leveraging the power of compounding, financial patience creates a stable pathway to realizing financial aspirations. As individuals cultivate financial patience, they nurture their capacity to achieve sustainable, lifelong financial independence.

FAQ

What practical steps can I take to improve my financial patience?

Improving financial patience involves setting clear and realistic financial goals, practicing mindful spending, continuously educating oneself about financial markets and investment principles, and seeking advice from experienced financial mentors or advisors to gain broader perspectives.

Why is the time value of money essential in wealth building?

The time value of money highlights the potential earning capacity of money over time, aiding in making informed investment decisions. By starting early and embracing long-term strategies, one can maximize the benefits of compounding interest, underscoring the necessity of financial patience.

How does patience influence investment success?

Patience influences investment success by allowing investors to weather market fluctuations and adhere to long-term strategies. It enables careful analysis and informed decision-making, minimizing the impact of emotional decisions driven by short-term market shifts.

What are the common pitfalls of failing to practice financial patience?

Common pitfalls include making impulsive, high-risk investments, abandoning long-term strategies during market downturns, and succumbing to get-rich-quick schemes which often result in financial losses rather than sustainable wealth.

Can balancing patience with actionable steps lead to better financial outcomes?

Balancing patience with actionable financial steps creates a dynamic approach that addresses long-term goals while remaining responsive to market conditions. This synthesis promotes sustained growth through strategic adjustments and informed decision-making.

Recap

- Wealth building requires long-term strategic planning, and patience is essential for success.

- Understanding the time value of money is crucial in appreciating how investments grow exponentially over time.

- Falling prey to misconceptions about quick wealth can derail financial progress.

- Patience fosters informed decision-making and resilience against market volatility.

- Long-term investment strategies, supported by case studies, demonstrate the tangible benefits of patience.

- Overcoming impatience involves setting realistic goals and seeking mentorship.

- Cultivating patience is an intentional process that can be achieved through continuous education.

- Balancing patience with strategic actions ensures a robust, adaptable, and effective financial strategy.

References

-

Fisher, K. L. (2017). Beat the Crowd: How You Can Out-Invest the Herd by Thinking Differently. Wiley.

-

Siegel, J. J. (2014). Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies. McGraw-Hill Education.

-

Kahneman, D. (2013). Thinking, Fast and Slow. Farrar, Straus and Giroux.

Deixe um comentário